Speak to a licensed agent (Monday-Saturday 8am - 8pm, Sunday 9am - 5pm)

(623) 223-8884 | TTY: 711

(623) 223-8884 | TTY: 711

Call Now

Call Now

Call Now

Call Now

Medicare Supplement plans provide additional peace of mind for residents enrolled in Medicare in Illinois. Known as Medigap, this plan helps cover the out-of-pocket costs that Original Medicare doesn’t, giving you added protection against unforeseen medical bills. With a complementary blend of parts A and B from Original Medicare plus your chosen supplement plan – together, they offer reliable coverage to ensure life’s most important moments are worry-free.

In Illinois, most Medicare beneficiaries are taking steps to safeguard their health and finances by supplementing Original Medicare with additional coverage. An estimated 65% of those enrolled in traditional Government-sponsored insurance have a Medigap plan or a Medicare Advantage policy that helps limit out-of-pocket costs associated with medical care.

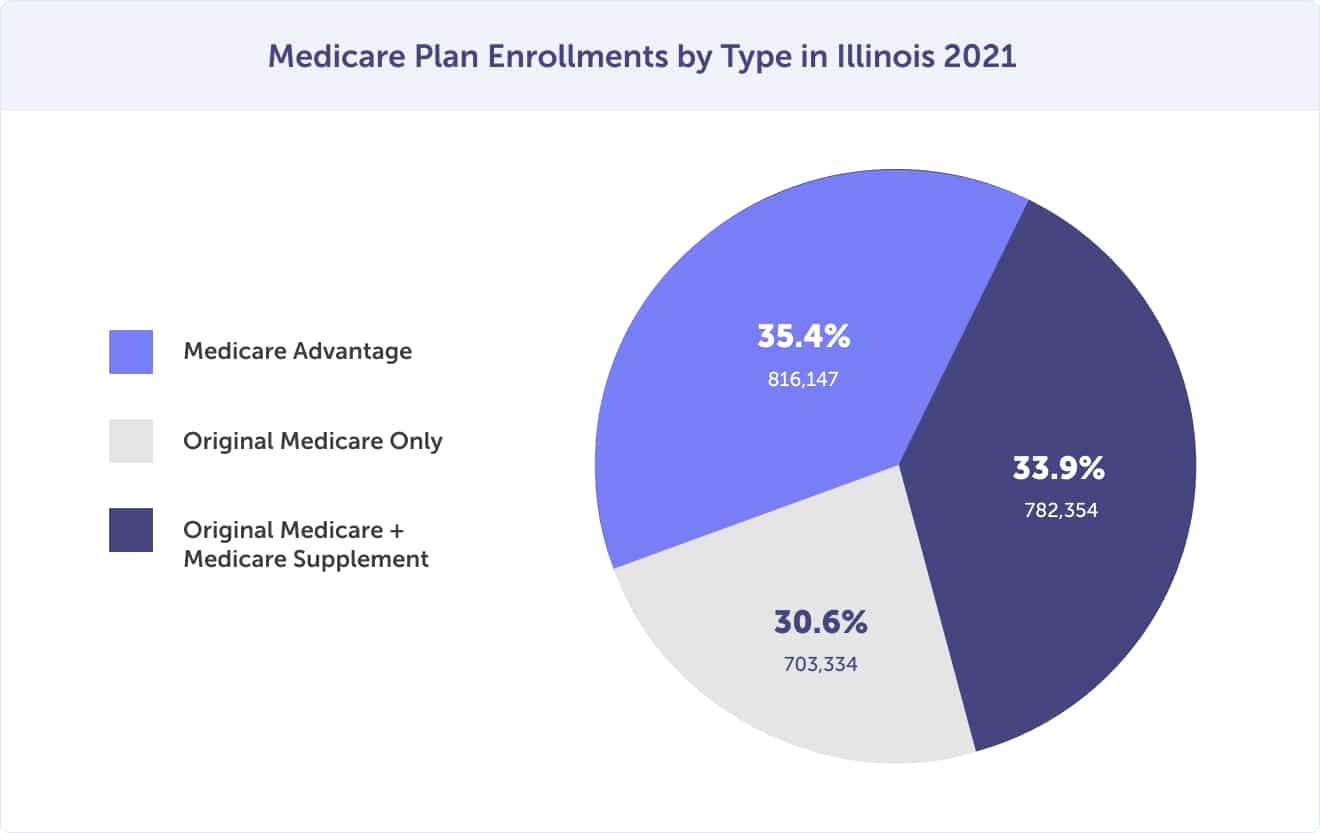

The State of Medicare Supplement Coverage by AHIP reported that 782,354 (33.9%) of Medicare enrollees were enrolled in Medicare Supplement coverage in 2021. That’s up from 34.6% in 2020 and 35.6% in 2019. Alternatively, 39.8% of Illinoisans are enrolled in a Medicare Advantage plan in Illinois in 2024.

In 2021, 35.4% of Medicare Eligibles were enrolled in a Medicare Advantage plan, 33.9% (782,354) enrolled in Original Medicare and a Medicare Supplement plan, while the remaining 30.6% were enrolled in Original Medicare without a plan to protect them from high out-of-pocket costs.

Residents of Illinois with Medicare Part A and Part B may find additional insurance coverage options in the form of a Medigap plan. Eligible individuals need only ensure they reside within the plan’s service area.

Original Medicare Parts A & B offer valuable coverage but without a maximum out-of-pocket cost. That means you’ll still be responsible for paying premiums and deductibles, plus 20% coinsurance for doctor bills and medical expenses – which can create hefty charges if you have an extended hospital stay (over 60 days) or receive care in skilled nursing facilities over 20 days. This is where having the extra protection of a Supplement plan comes into play – helping protect your budget from unexpected costs.

Medicare Supplement plan coverage varies from plan type but can include:

Medicare Supplement plans don’t cover prescription drugs, so you’ll need to enroll in a separate Part D plan if your existing coverage isn’t deemed “creditable” by the Centers for Medicare & Medicaid Services (CMS).

By electing not to enroll in a Medicare Part D standalone prescription drug plan at the same time you join a Medicare Supplement plan, you could be subject to an increasing late enrollment penalty. This consequence is imposed through higher premiums that persist over your entire period with a Prescription Drug Plan. And unfortunately, it’s a penalty that must be paid for as long as you have a Medicare prescription drug plan—so don’t delay and sign up on time.

Learn more about the types of Medicare plans in Illinois, including Medicare Part D plans.

Agent tip:

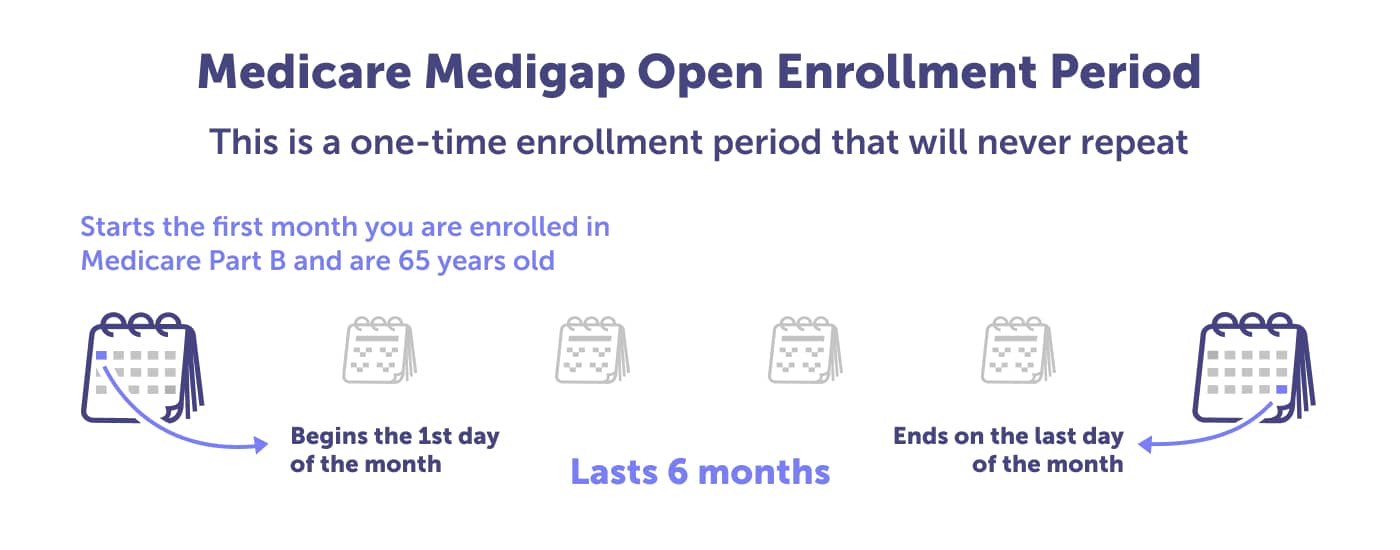

“The Medigap Open Enrollment Period begins when you’re enrolled in Medicare Part B and age 65 – and lasts 6 months. If you miss this enrollment, you may be denied Medigap coverage because of medical underwriting.“

For those in Illinois, there are multiple private insurers approved by the Illinois Department of Insurance and ten standardized types of Medicare Supplement (Medigap) plans. These can act as a valuable shield from out-of-pocket expenses associated with Original Medicare and alleviate any financial stress you may have on your healthcare needs. Plans range from A to N, but every carrier must offer at least Plan A for customers – though prices may vary between companies.

With a wide range of coverage options, Medicare Supplement plans provide customizable care and financial protection. There are 10 plans to choose from in Illinois, but there may be only a portion available to you. That’s because two popular choices among beneficiaries, Plan C and Plan F, are only available to people who turned 65 before January 1, 2020. If you turned 65 on or after January 1, 2020, you cannot enroll in these plans because they have been phased out.

The five most popular Medicare Supplement plans in Illinois are:

Illinois seniors looking for a Medicare Supplement plan that’s similar to the now discontinued Plan F should take notice: Plan G has emerged as an excellent alternative, becoming the second most popular choice amongst those in Illinois.

New to Medicare and wondering which Medicare Supplement plan is right for your health and budget? Use our online tool to review plan options, or call (623) 223-8884 to speak with a local licensed agent.

When shopping for Medicare Supplement plans in Illinois, it’s essential to evaluate both monthly premiums and out-of-pocket costs. While cheaper rates can be appealing, they may come with higher additional expenses – making a balanced plan analysis important.

With Medicare Supplement Plan G, you can enjoy basic coverage and more than a few extras. From 100% Part B coinsurance, Part A coinsurance, or hospice copay paid at 100% – to three pints of blood per benefit calendar year, it’s no wonder why this is the second most popular Medigap plan among those offered A through G.

In addition to these essentials, additional benefits include skilled nursing facility coinsurance, Part A deductibles, Part B excess charges, and foreign travel emergency expenses.

Plan N is the second most popular Medicare Supplement plan in Illinois and the most popular amongst Medigap plans K through N. Unlike plans A through G, K through N don’t have uniform benefits. Instead, each plan provides unique benefits, and you should consult a local Medicare agent to discuss which plan option is best for your health and budget. Call (623) 223-8884 or browse Medicare Supplement plans online.

With Medicare Supplement plans, you can enjoy secure coverage and the same rate regardless of age. You lock in your rate at the time of sign-up. All it takes is selecting a plan that suits your lifestyle – male or female, smoker or non-smoker – to access consistent premiums throughout your life’s journey.

As of 2024, you could expect a monthly premium of $35 to $412 as a 65-year-old non-smoking woman. And a 65-year-old smoking woman could pay between $40 and $474 depending on plan choice.

As of 2024, you could expect a monthly premium of $40 to $465 as a 65-year-old non-smoking man. And a 65-year-old smoking man could pay between $45 and $535 depending on plan choice.

There are similarities to how you might choose between a Medigap and Medicare Advantage plan or a PPO and HMO plan – network flexibility and cost.

With Medicare Supplement plans, you can visit any healthcare provider that Medicare approves in Illinois. If a more specific set of benefits is desired, it may be worth considering opting for a Medicare Advantage plan in Illinois. These plans typically offer additional coverage, such as dental, hearing, and vision services. However, they have a more limited provider network. So, you’ll need to weigh the networks and benefits.

Medicare Advantage and Medigap plans can help you cover health care costs associated with Original Medicare. However, the average monthly premium for a Medicare Advantage plan is far lower ($11.39) than that of a Medigap plan – which ranges from $40 to over $500 depending on certain factors such as gender or smoking status.

Both plans help cover some or all of the out-of-pocket expenses you might encounter with Original Medicare. Nearly 34% of Illinoisians were enrolled in a Medigap plan in 2021, while in 2024, 39.8% are enrolled in a Medicare Advantage plan in Illinois.

Not sure whether a Medicare Supplement plan in Illinois or a Medicare Advantage plan is right for you? Review plan options online or call (623) 223-8884 to speak with a local licensed agent to help you sort through your health care plan options.

With increasing healthcare costs, many seniors are turning to Medicare Supplements for more control over out-of-pocket spending. Affordable coverage options provide greater peace of mind and financial predictability – so you can rest easy.

If you’re looking for a Medicare Supplement plan in Illinois, your best bet is to enroll during the Medigap Open Enrollment Period. This period allows individuals with pre-existing medical conditions to receive coverage from any chosen plans without prejudice – at great prices too.

Missing your Medicare Supplement (Medigap) Open Enrollment Period can have far-reaching consequences. The Medigap Open Enrollment Period starts the first month you are enrolled in Medicare Part B, and you’re at least age 65. This window of opportunity to purchase a Medigap policy only lasts six months. It cannot be repeated if you miss it – leaving you exposed to potentially higher premiums due to past or present health conditions.

During Medigap Open Enrollment, insurance carriers waive their pre-existing clause for new Medicare Supplement plans. This is why you must mark this critical window on your calendar.

Missing your Medigap Open Enrollment Period can mean missed opportunities for coverage. Insurance companies are not obligated to sell you a plan and may require medical underwriting – something that does not come into play during Medigap Open enrollment. Through this process, insurance providers decide whether to accept an application and set policy costs accordingly.

Some situations exclude you from insurance companies requiring underwriting.

As of January 1, 2022, the state of Illinois made an exception to the “one-time” Medigap Open Enrollment Period’s pre-existing clause. You won’t want to miss out on this! During this time, a carrier cannot deny or discriminate in coverage pricing because of health status, past claims, receipt of health care, or a medical condition.

If you enroll in a Medigap plan and you’re not satisfied, you have 45 days from your birthday to change to another Medigap plan. This second chance allows you to make a better choice for yourself without underwriting.

Not sure which Medicare Supplement plan is best for your health and budget? Review your plan options online or call (623) 223-8884 to speak with a local licensed agent who can guide you.

Bill Status of SB0147.

Guaranteed issue rights.

How to compare Medigap policies.

MA State/County Penetration, December 2019.

MA State/County Penetration, December 2020.

MA State/County Penetration, February 2023.

Medicare Open Enrollment in Illinois, 2023.

Supplement Insurance (Medigap) plans in Illinois.

The State of Medicare Supplement Coverage, 2021.

The State of Medicare Supplement Coverage, 2020.

The State of Medicare Supplement Coverage, 2019.

With more than 10 Medicare Supplement plan types available in Illinois, it can be hard to figure out which is right for you. Research and compare coverage options side-by-side – the ‘best’ plan will depend on your needs and budget constraints. It’s essential to look at monthly premiums and any additional benefits that might save money, like prescription discounts or vision care services.

While shopping around for a Medicare Supplement plan, Illinois residents often find themselves drawn to Plans G and N. These are the top two choices among new enrollees in the state – with Plan G being by far the most popular pick. These Medigap plans should be on your radar if you’re reviewing your options.

Read more by Renee van Staveren

Since 2009, I've been writing about complicated, technical issues, with the goal of making topics like Medicare and healthcare easier to understand. I've been writing about Medicare since 2021 and healthcare since 2019. I am an AmeriCorps alumni. I enjoy gardening, reading, and DIYing.